Texas HB 2067 Requires Insurance Companies to Explain Homeowners Policy Cancellations Starting 2026

Insidewoodlands

Archives

Texas HB 2067 Requires Insurance Companies to Explain Homeowners Policy Cancellations Starting 2026

SIGN UP FOR OUR NEWSLETTER

Texas Insurance Companies Must Disclose Cancellation Reasons Under New Transparency Law |

HB 2067 eliminates vague excuses as homeowners face wave of policy drops and soaring premiums |

Texas homeowners finally get clarity about why their insurance companies drop them starting in 2026.

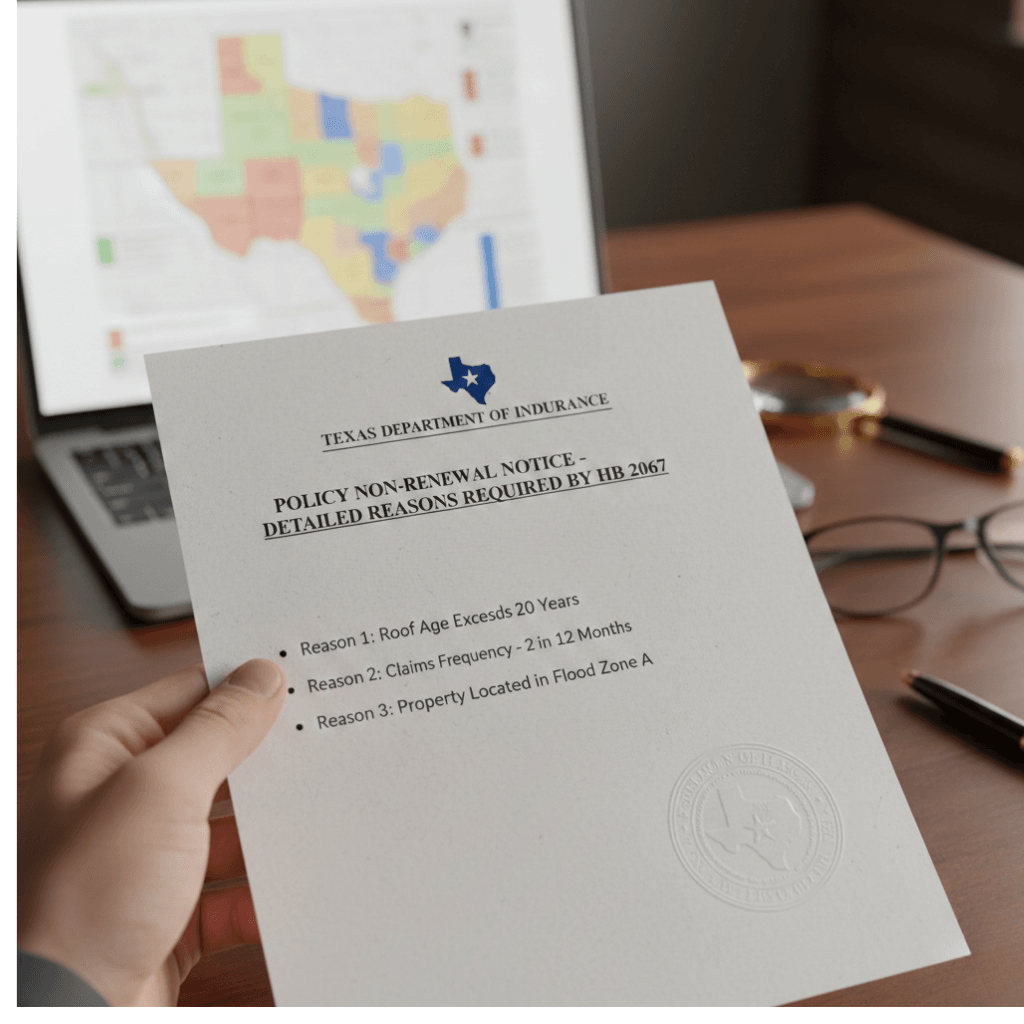

House Bill 2067 demands written explanations whenever insurers cancel, decline, or refuse to renew policies — ending the era of mysterious rejections.

The law creates a data goldmine for frustrated consumers and state regulators tracking patterns in coverage denials.

Insurers must file quarterly reports with the Texas Department of Insurance summarizing their reasons for policy actions by ZIP code, which will be published online without identifying specific companies.

The timing couldn't be more critical.

Nearly half of all homeowners insurance claims in Texas were closed without payment in 2024, up from 35% in 2016.

Nonrenewal complaints more than doubled this year as major carriers like Progressive and Farmers Insurance scale back operations in the state.

The old system allowed insurers to cancel policies with minimal explanation.

Now they must spell out specific reasons — whether it's storm exposure, claims history, or property condition.

The transparency rules apply to applications and policies made or renewed after January 1, 2026.

Texas homeowners insurance rates climbed nearly 19% in 2024, following a 21% spike between 2022 and 2023.

Some homeowners now face annual premiums between $10,000 and $15,000 from lesser-known carriers.

The Texas FAIR Plan, designed as last-resort coverage, has become a lifeline for thousands.

Enrollment jumped from 73,000 in September 2023 to over 100,000 by September 2024.

Industry resistance to the new rules appears minimal.

The Texas Department of Insurance previously endorsed the transparency concept and included similar recommendations to lawmakers.

The legislation allows electronic delivery of cancellation notices and updates existing law to include "declination" alongside traditional cancellation and nonrenewal provisions.

For commercial insurance customers, agents must now receive declination notices directly and share that information with their clients.

State regulators plan a three-phase implementation, starting with residential property and auto insurance reporting requirements.

State Senator Lois Kolkhorst and other lawmakers championed the measure as essential consumer protection during Texas's insurance crisis.

The ZIP code data will help policymakers identify trends and "figure out ways to fix that," according to legislative supporters.

Homeowners who receive cancellation notices can finally understand whether they're being dropped for legitimate underwriting reasons or swept up in broader market retreats. |